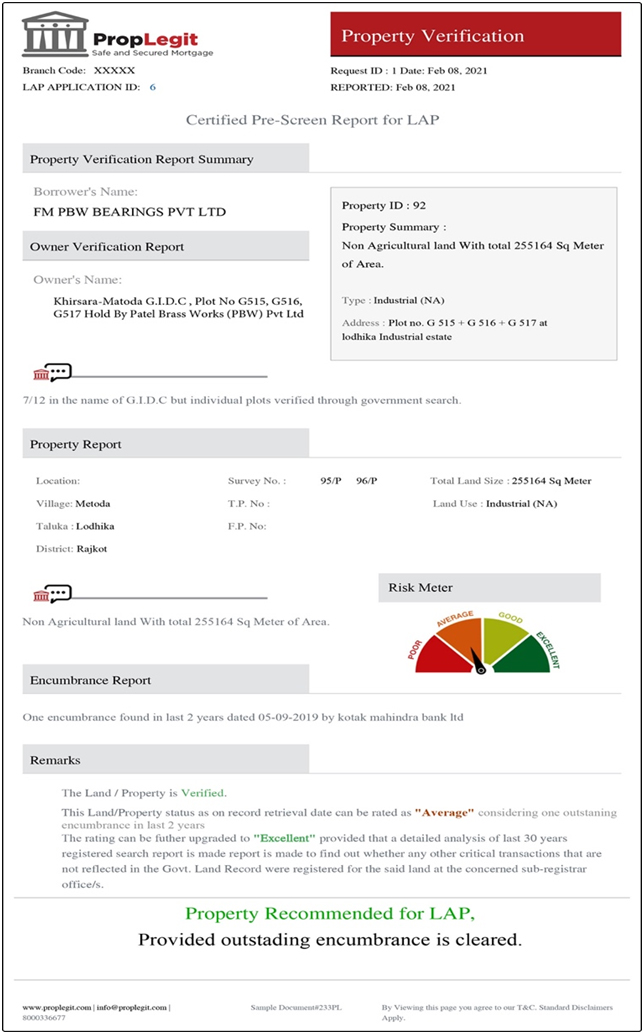

A Due-diligence and a “Go-No-Go” decision making tool for banks and financial sector:

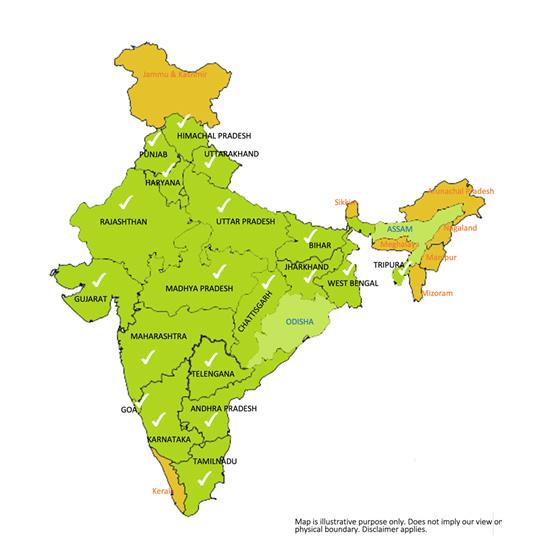

PropLegit is a property intelligence and mortgage sanction facilitator for the BFSI sector. Instantly verifies property details with real time government records data and information available on the public platform across 19 States of India.

Integrated Loan Products

Agriculture and Farm Loans

Home Loans

MSME Loans

Consumer Vehicle Loans

Industrial Loans

Pre-sanction Mortgage Stage

- Instant Property Verification as per latest available Government Record

- Instant Ownership Verification as per latest available Government Certified Revenue / Land Records

- Instant Red Flags on Lien and Encumbrances for past 2 to 12 years

- On demand Encumbrance upto available records or max 30 years

- Co-ownership Data

- Applicant Share (Co-applicant wise share) in required unit of measurement

- Integrated Risk meter that enables knowledge based decision making

Post Mortgages

- CERSAI Record updation

- Hypothecation Registration in Revenue Records

- Alerts for changes in Revenue Record, issue of Public Notice - compliance and due-diligence enabler

In Mortgage Stage

- On-Demand Property Status along with Risk Meter

- Periodic Property Audit

- Mortgage Property Protection, due-diligence and compliance enabler

Rs 6.16 Lakh crore NPA as on March 31, 2021

FAQ’s

- What does PropLegit have to offer to BFSI Sector?

-

PropLegit offers a dynamic and a real time integrated software platform and a due-diligence tools for banks to make critical go-no-go decision and speed up the pre-sanction mortgage process.

- Is it fully automated for BFSI sector?

-

PropLegit has automated across 19 States of India to fetch the requested property related information for banks and financial sector

- How does banks and financial sector use PropLegit service?

-

PropLegit has a standalone cloud based application for banks and also a sandbox environment which can be integrated to the banks LOS and LLMS product journeys via a RESTapi.

- Can we do a POC (Proof-of-Concept) with PropLegit?

-

PropLegit encourages proof of concept with banks and financial sector. Receive live engagement for upto 4 states and for upto 100 survey numbers per State. We charge a fixed cost per State and which can be shared on request. Demo is Free

- How long does it take PropLegit to setup a stand alone environment?

-

It takes less than 3 days for PropLegit to setup a cloud environment for any bank or financial institute. We train your staff to configure the system state-wise and on how to use. Once set up, the authorized Bank officers can make live request queries for any property instantaneously.

- How fast can the sandbox environment be setup?

-

The PropLegit sandbox environment is ready for generating iPVRacross 19 States of India. We take just One day to setup the same.

- Are post mortgage protection and In mortgage stage services available at this point in time?

-

These are customized offerings based on your requirements and we can work them out on case to case basis. Please get in touch with us.

Sign In

Sign In About Us

About Us